Sell on Amazon.com

In the Green — Selling sustainable living on Amazon.com with Aerospring Hydroponics

It’s one thing to be able to sell a niche product on amazon.com, but another to be able to grow a business steadily, with a consistent year-on-year increase in sales. This is just what Singapore-based Aerospring Hydroponics has achieved since they started selling their indoor and outdoor hydroponic systems on amazon.com in 2019. Here, we sat down for a chat with Mark Newton, Chief Operating Officer of the company, to learn more about how the brand has grown in this niche gardening hobby industry over the years. This is part 2 of an interview series with the Singapore-based brand. Part 1 of interview series where we understand how the brand was started, can be read here.

The days of lockdowns and self-isolation might be well behind us, but if there’s one positive Covid-19 trend we’re happy to see remain, it’s the growing awareness of the importance of food self-sufficiency.

Just a couple of years ago, we experienced first hand how scary food supply disruptions can be, especially as a nation overly-dependent on food imports. Even today, food prices continue to fluctuate due to global political and economic instability, with many items seeing further increases in costs due to inflation, a shortage of raw materials, or increased costs of labour. Aside from that, there’s also a growing concern over the nutritional value of the food that we consume, not only in the way that it’s prepared, but in the way that it’s grown and cultivated as well. These many concerns have led some to think: surely, there must be another way.

In response to this, hydroponics have seen a resurgence in popularity in the past couple of years, and for good reason—hydroponic growing can potentially help plants grow 30% faster, while using 90% less water than conventional soil growing.

This might be one of the reasons why Aerospring Hydroponics, a Singapore-based company that designs and manufactures indoor and outdoor hydroponic systems for home use, has maintained a consistent year-on-year increase in sales since becoming an Amazon Global Seller in 2019. The company sells to schools and individuals in the US, Singapore, and around the world, with the purpose of spreading the joys of growing produce at home.

Of course, a growing awareness of the importance of food self-sufficiency alone isn’t enough to keep sales on the uptick. Rather, a combination of leveraging their reach among North American consumers and making full use of the brand building and advertising tools available on amazon.com is what has helped Aerospring drive sales for products as niche as theirs over the years. In fact, just last year, they saw a 58% increase in year-on-year sales between Prime Day 2021 and Prime Day 2022.

That said, there’s a lot that we can learn from Aerospring’s success, so we sat down once again with their Chief Operating Officer, Mark, to gather even more tips and tricks on selling niche products with a long decision-making cycle online on amazon.com. Read on for more, and catch up on our previous chat with Mark and Aerospring Hydroponics’ co-founder Thorben here.

Just a couple of years ago, we experienced first hand how scary food supply disruptions can be, especially as a nation overly-dependent on food imports. Even today, food prices continue to fluctuate due to global political and economic instability, with many items seeing further increases in costs due to inflation, a shortage of raw materials, or increased costs of labour. Aside from that, there’s also a growing concern over the nutritional value of the food that we consume, not only in the way that it’s prepared, but in the way that it’s grown and cultivated as well. These many concerns have led some to think: surely, there must be another way.

In response to this, hydroponics have seen a resurgence in popularity in the past couple of years, and for good reason—hydroponic growing can potentially help plants grow 30% faster, while using 90% less water than conventional soil growing.

This might be one of the reasons why Aerospring Hydroponics, a Singapore-based company that designs and manufactures indoor and outdoor hydroponic systems for home use, has maintained a consistent year-on-year increase in sales since becoming an Amazon Global Seller in 2019. The company sells to schools and individuals in the US, Singapore, and around the world, with the purpose of spreading the joys of growing produce at home.

Of course, a growing awareness of the importance of food self-sufficiency alone isn’t enough to keep sales on the uptick. Rather, a combination of leveraging their reach among North American consumers and making full use of the brand building and advertising tools available on amazon.com is what has helped Aerospring drive sales for products as niche as theirs over the years. In fact, just last year, they saw a 58% increase in year-on-year sales between Prime Day 2021 and Prime Day 2022.

That said, there’s a lot that we can learn from Aerospring’s success, so we sat down once again with their Chief Operating Officer, Mark, to gather even more tips and tricks on selling niche products with a long decision-making cycle online on amazon.com. Read on for more, and catch up on our previous chat with Mark and Aerospring Hydroponics’ co-founder Thorben here.

1. Can you tell us more about how hydroponic vegetables compare to traditional soil-grown, imported vegetables?

For starters, you can actually yield a lot more vegetables when you grow them hydroponically—in fact, you can grow up to 6-8kg of fresh produce per month with our systems, which is more than enough to feed a small family, let alone couples or individuals. And once you start growing your own produce at home, you’ll realize just how tasty fresh, quality vegetables can be.

I live in Singapore, and the tomatoes that I find in the supermarket are either crazily overpriced because they’ve been imported from far-off Western countries, or taste bland and sad, mainly because they've lost freshness during the delivery process. This is why I always advocate for growing your own produce at home, because it’s really not that tough, and the benefits you’ll reap are well worth the effort and initial investment.

I live in Singapore, and the tomatoes that I find in the supermarket are either crazily overpriced because they’ve been imported from far-off Western countries, or taste bland and sad, mainly because they've lost freshness during the delivery process. This is why I always advocate for growing your own produce at home, because it’s really not that tough, and the benefits you’ll reap are well worth the effort and initial investment.

2. How has your journey of selling on amazon.com been in recent years, with the growth in gardening hobbyists?

Covid-19 impacted the world in many aspects, one of which was the access to fresh produce. In Singapore, supermarket shelves were emptied in a flash, and that actually got people thinking more about growing their own food. It really turned our business around and helped us grow as a brand; we more than broke even during that time.

With more people working from home, a growing interest in our product category, and customers having greater disposable income, I would say we were fortunate to be able to thrive during the past years. The situation also required us to spend more of our energy on e-commerce, which really helped our business. We’re riding on the global trend of sustainability, empowering people to live more sustainably by growing their own food at home.

As home gardening is considered a hobby market, emerging out of the pandemic, we’ve also seen demand and interest dip over the past year as more people return to the office. But despite all of that, I’d say amazon.com has helped us in this aspect because of the wide consumer pool, which has allowed us to continue to scale and grow our business over the years. In fact, we managed to increase our sales on amazon.com by 54% year-on-year. We’re looking into introducing new complementary products, like fertilisers and digital pH meters, to increase customer lifetime value.

Our products are available across the US, and can be delivered to all 50 states. Additionally, around 25% of our US sales are with schools who purchase our products on Amazon.com, where educators have been using them to teach kids about urban farming. Here in Singapore, we also work with a number of schools—around 40 to 50 of them—where we sometimes go down to host workshops, deliver talks, or just to educate teachers and kids alike about our systems and the importance and joys of growing your own food.

With more people working from home, a growing interest in our product category, and customers having greater disposable income, I would say we were fortunate to be able to thrive during the past years. The situation also required us to spend more of our energy on e-commerce, which really helped our business. We’re riding on the global trend of sustainability, empowering people to live more sustainably by growing their own food at home.

As home gardening is considered a hobby market, emerging out of the pandemic, we’ve also seen demand and interest dip over the past year as more people return to the office. But despite all of that, I’d say amazon.com has helped us in this aspect because of the wide consumer pool, which has allowed us to continue to scale and grow our business over the years. In fact, we managed to increase our sales on amazon.com by 54% year-on-year. We’re looking into introducing new complementary products, like fertilisers and digital pH meters, to increase customer lifetime value.

Our products are available across the US, and can be delivered to all 50 states. Additionally, around 25% of our US sales are with schools who purchase our products on Amazon.com, where educators have been using them to teach kids about urban farming. Here in Singapore, we also work with a number of schools—around 40 to 50 of them—where we sometimes go down to host workshops, deliver talks, or just to educate teachers and kids alike about our systems and the importance and joys of growing your own food.

Whether in schools or at home, Aerospring’s hydroponic systems are used to teach kids about urban farming. Image courtesy of Mark Newton.

3. We understand that your product has a longer decision making cycle, and that there are many factors for customers to consider throughout the purchasing process. How do you optimize your listings on amazon.com, and your Brand Store page to increase conversions? Can you tell us a bit more about what experiments you’ve ran with regard to this?

For starters, we’ve been doing a tremendous amount of work upgrading our A+ Content on our Brand Store. Previously, our A+ Content was very text-heavy, with minimal images and lots of textual information comparing and contrasting the different types of systems that we offer. Now, we’ve streamlined the way in which we present this information by including larger, clearer photographs of our products, and listing its features in concise bullet points.

The old wordy Aerospring A+ Content (L), and the new and improved version (R) featuring lifestyle images and concise bullet points. Screenshots courtesy of Mark Newton.

We’ve found that this has helped us drive more conversions as it provides customers with a clearer picture of what they can expect to receive and experience with our products before they actually take the plunge to purchase it.

Secondly, we’ve also revamped our Amazon storefront page to similarly streamline the copy and flow of content, which has allowed us to better communicate our brand vision and story, as well as highlight key products in a more succinct way.

Secondly, we’ve also revamped our Amazon storefront page to similarly streamline the copy and flow of content, which has allowed us to better communicate our brand vision and story, as well as highlight key products in a more succinct way.

The old text-heavy, cluttered Aerospring Amazon brand storefront page (L), and the new and improved version (R) featuring streamlined content and clear images. Screenshots courtesy of Mark Newton.

Since implementing this new and improved A+ Content across all of our products, and refreshing our brand’s amazon.com Brand Store page, we have seen a marked increase in all of our key metrics in the primary categories that we track.

These include:

• Customer conversion rate: +66-73%

• Percentage of new-to-brand customers: +5-28%

• Awareness: +39-50%

• Brand searches and detail page views: +7-9%

• Add-to-cart clicks: 25-32%

We have yet to explore using Premium A+ Content or the Amazon Manage Your Experiments tool, but we definitely plan to look into that this year.

These include:

• Customer conversion rate: +66-73%

• Percentage of new-to-brand customers: +5-28%

• Awareness: +39-50%

• Brand searches and detail page views: +7-9%

• Add-to-cart clicks: 25-32%

We have yet to explore using Premium A+ Content or the Amazon Manage Your Experiments tool, but we definitely plan to look into that this year.

4. What tips do you have for major shopping events like Prime Day and Black Friday, Cyber Monday?

We typically increase our ad spend for Prime Day and Black Friday Cyber Monday. While we haven’t released many deals around sales period, we have seen a good halo effect of these sales periods on our own sales, and use coupons as a promotional mechanic.

Looking at the Prime Day periods in recent years, we’ve generally seen a 40-45% increase in sales during Prime Day, and we’ve seen a daily increase of 400-500% in sales during the actual Prime Day Prime Day period. Overall, between Prime Day 2021 and Prime Day 2022, we’ve seen a 58% increase in year-on-year sales.

Looking at the Prime Day periods in recent years, we’ve generally seen a 40-45% increase in sales during Prime Day, and we’ve seen a daily increase of 400-500% in sales during the actual Prime Day Prime Day period. Overall, between Prime Day 2021 and Prime Day 2022, we’ve seen a 58% increase in year-on-year sales.

5. In instances like these where you see an uptick in sales, how do you plan your inventory? Do you plan ahead to reduce shipping and logistics costs, given that your products are considered bulky items?

In terms of inventory planning, we’ve found that our sales are higher when using Fulfilment by Amazon (FBA), so we’ll always try to ensure that we have enough stock in FBA to meet the estimated additional demand during key sales periods.

A lot of our customers in the US are Prime members, and they’re aware that they get 2-day free shipping on our Fulfilled-by-Amazon (FBA) products with an Amazon Prime membership within the continguous US. Generally, when they see they have to pay for shipping, I think they would rather wait until the products are back in stock on FBA, or just not make a purchase.

In terms of shipping and logistics costs, it was a major challenge of ours in 2021, but not so much since then as shipping delays have since eased. We use a dual strategy with our inventory, and don’t usually commit 100% of our stock to FBA for our larger products, just in case we experience any delays in check-ins or other logistical hiccups along the way, because it can be troublesome to resolve, especially when customer orders are at stake. This is why even though customers prefer purchasing with FBA, we’ll still reserve some stock for Fulfilment by Merchant.

A lot of our customers in the US are Prime members, and they’re aware that they get 2-day free shipping on our Fulfilled-by-Amazon (FBA) products with an Amazon Prime membership within the continguous US. Generally, when they see they have to pay for shipping, I think they would rather wait until the products are back in stock on FBA, or just not make a purchase.

In terms of shipping and logistics costs, it was a major challenge of ours in 2021, but not so much since then as shipping delays have since eased. We use a dual strategy with our inventory, and don’t usually commit 100% of our stock to FBA for our larger products, just in case we experience any delays in check-ins or other logistical hiccups along the way, because it can be troublesome to resolve, especially when customer orders are at stake. This is why even though customers prefer purchasing with FBA, we’ll still reserve some stock for Fulfilment by Merchant.

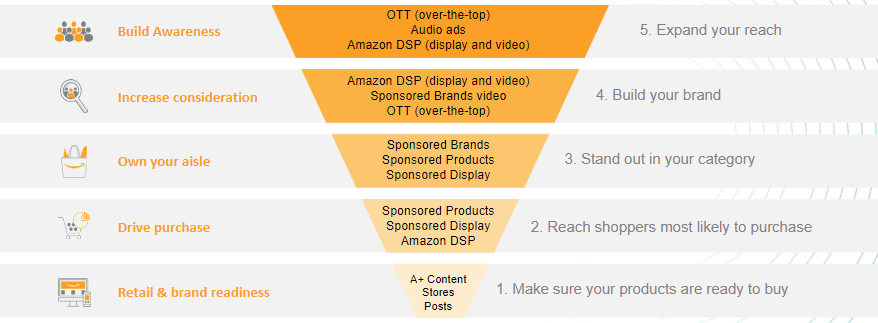

Amazon’s full marketing funnel—for optimal results, sellers should start with the customer experience and work their way up.

6. Tell us more about your budget allocation for Amazon Sponsored Products, Sponsored Brands, and Sponsored Display ads

We typically focus more on Sponsored Products ads (about 70% of our budget) as this is what mainly drives our sales and return on ad spend (ROAS). For the remaining 30%, we split it evenly between Sponsored Brands and Sponsored Display ads for the full marketing mix.

What we’ve noticed is that Sponsored Brands ads have an impact on our brand presence and awareness. Our most successful Sponsored Brands campaigns are actually product-targeted, both at our own products and our competitors’ products, though we’ve seen the most success in the former.

What we’ve noticed is that Sponsored Brands ads have an impact on our brand presence and awareness. Our most successful Sponsored Brands campaigns are actually product-targeted, both at our own products and our competitors’ products, though we’ve seen the most success in the former.

An example of Aerospring’s Sponsored Display ads. Screenshot courtesy of Mark Newton.

Examples of Aerospring’s Sponsored Brands ads. Screenshots courtesy of Mark Newton.

We’ve also used Views Remarketing through Sponsored Display ads to some degree of success. As our products are high consideration purchases, we’ve adjusted the lookback window to 30 days, and are currently testing a longer window of 60 days. For this, we focus on our own products, but are now testing category targeting.

Still, we choose to go heavy on the Sponsored Products ads as we can better target competitor products and brands with our marketing.

Our Sponsored Products ad campaigns are generally broken down into two groups—broad match and phrase and exact match. Broad match would include keywords like “hydroponic tower garden” and “indoor growing system”, and work to boost exposure, while phrase and exact match would include keywords like “ “hydroponic system”, “hydroponic tower” and “indoor garden”, which works for targeted relevance. But generally, phrase and exact keywords perform better for us.z

Still, we choose to go heavy on the Sponsored Products ads as we can better target competitor products and brands with our marketing.

Our Sponsored Products ad campaigns are generally broken down into two groups—broad match and phrase and exact match. Broad match would include keywords like “hydroponic tower garden” and “indoor growing system”, and work to boost exposure, while phrase and exact match would include keywords like “ “hydroponic system”, “hydroponic tower” and “indoor garden”, which works for targeted relevance. But generally, phrase and exact keywords perform better for us.z

We also further break down our Sponsored Products ad campaigns into indoor and outdoor campaigns, or even accessories campaigns, and keep each ad group to 30 keywords or less. We also constantly monitor the suggested keyword bids and switch them up accordingly if need be to ensure that we’re keeping up with the most competitive bids.

For us, our guiding principle has always been the Return on Advertising spend (ROAS), so we tend not to spend money on keywords with poor performance, or competitive products. We also use dynamic bids, and occasionally increase our bids to appear at the top of search and product pages.

For us, our guiding principle has always been the Return on Advertising spend (ROAS), so we tend not to spend money on keywords with poor performance, or competitive products. We also use dynamic bids, and occasionally increase our bids to appear at the top of search and product pages.

Examples of Aerospring’s Sponsored Products ads. Screenshots courtesy of Mark Newton.

7. Can you elaborate a bit more on how you look at your brand’s ROAS in relation to your Advertising Cost of sales (ACoS) and Total Advertising Cost of Sales (TACoS)?

Our customer’s typical consideration period before purchasing our products is 14-30 days, and this falls outside of the Amazon lookback window, and is thus not tracked by the Amazon ROAS or ACoS. We therefore look at our market spend and conversions in aggregate, or TACoS. Since we know that a lot of our US customers prefer to visit our website before making a purchase on Amazon, this calculation makes more sense for us to attribute organic sales accurately.

Amazon tip:

ACoS tells you how much of your spend is being used towards sales that are made as a direct result of your PPC ads. In other words, ACoS is NOT taking into account your other sales made organically (e.g. when a customer has a long decision making cycle and searches for your product 1 month after viewing your ad, then makes an Amazon purchase)

TACos = (Advertising Spend / Total Revenue) 100

ACoS = (Advertising Spend / Advertising Sales) 100

TACos = (Advertising Spend / Total Revenue) 100

ACoS = (Advertising Spend / Advertising Sales) 100

8. Considering how Aerospring’s products are niche, high-consideration, and big ticket, yet are still doing well in terms of year-on-year sales, what are some tips that you have when it comes to selling on amazon.com?

There are a few factors that have contributed to our success as a niche brand selling big-ticket products, one of which is that we try our best to provide as much information about our products and what customers can expect in terms of the assembly, setup, and maintenance of our systems as possible before they make a purchase.

When we list each of our products on amazon.com, we highlight key features, benefits, size, assembly requirements and the like so that customers can make the most informed decision before purchasing our products, because running a successful business isn’t just about driving sales, but also about minimizing returns, which can be quite costly to manage, especially for bulky items like ours.

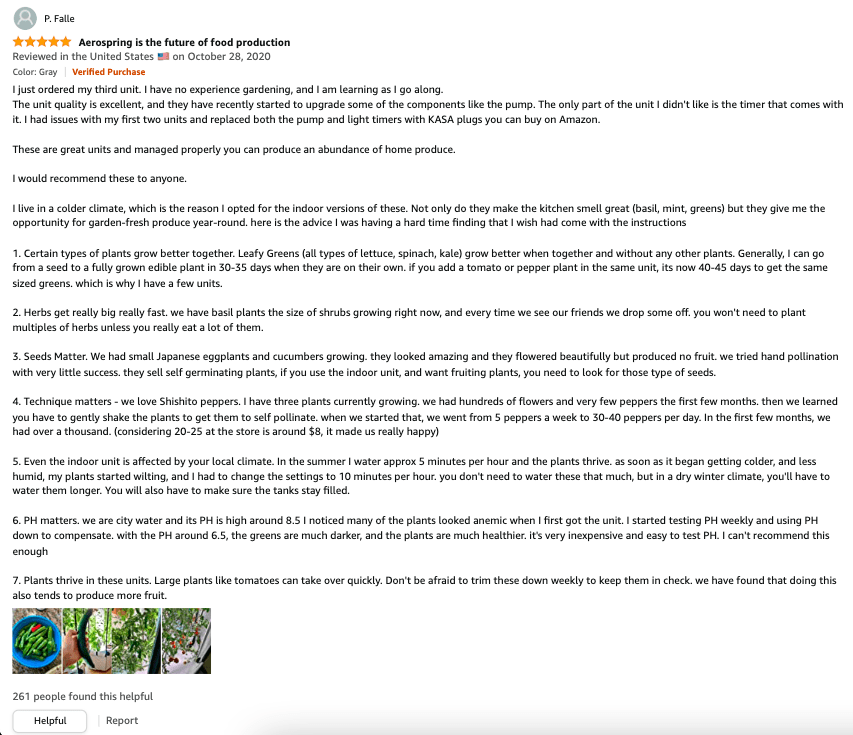

Something else we’ve found helpful are the detailed reviews that our happy customers leave. You know how customer reviews on amazon.com are usually only a couple of lines long? Well, for our products, reviews typically run paragraphs, and they’re so heartfelt and genuine that it’s always a joy for us to read through them. They also carry a lot of weight when it comes to convincing customers who are on the fence about purchasing our products.

When we list each of our products on amazon.com, we highlight key features, benefits, size, assembly requirements and the like so that customers can make the most informed decision before purchasing our products, because running a successful business isn’t just about driving sales, but also about minimizing returns, which can be quite costly to manage, especially for bulky items like ours.

Something else we’ve found helpful are the detailed reviews that our happy customers leave. You know how customer reviews on amazon.com are usually only a couple of lines long? Well, for our products, reviews typically run paragraphs, and they’re so heartfelt and genuine that it’s always a joy for us to read through them. They also carry a lot of weight when it comes to convincing customers who are on the fence about purchasing our products.

An example of a typical detailed customer review on Aerospring’s Amazon product listing.

In fact, we always say that our customers are our best salespeople and advocates, because there’s nothing more convincing than rave reviews, or actually going over to someone’s home and seeing one of our systems and all that it has to offer for oneself.

Apart from that, since we’ve been selling on amazon.com since 2019, we’re starting to get a good grasp on seasonality data, which has helped to guide our sales and logistics planning pretty effectively.

Apart from that, since we’ve been selling on amazon.com since 2019, we’re starting to get a good grasp on seasonality data, which has helped to guide our sales and logistics planning pretty effectively.

9. Do you have any tips for new sellers looking to sell niche products and tap into the wide customer pool of amazon.com?

Do your research and rely on data to drive your sales and advertising tactics. Use keyword research tools to look up customer painpoints and competitor brands, and don’t just keep an eye on your own product reviews, but that of your competitors as well, so that you can see what’s good and what’s not so good, what customers want and don’t want, and suss out any gaps that you could potentially fill in the industry.

But at the end of the day, you have to find joy in your product. For us at Aerospring, we hope to spread the joy of urban farming, and to show people how it’s really not that difficult to grow and reconnect with food at home.

But at the end of the day, you have to find joy in your product. For us at Aerospring, we hope to spread the joy of urban farming, and to show people how it’s really not that difficult to grow and reconnect with food at home.

10. Finally, what are some of your proudest moments throughout your journey with Aerospring Hydroponics?

I guess for me, it’s all about seeing more people reconnect with their food through the mere act of taking the time to learn about and grow their own produce, which is why I always love reading customer reviews and hearing from happy buyers and growers. It's just a great feeling knowing that we’ve been able to impact people and the world in a positive way through sustainability and by simply spreading our passion and love for what we do.

Spending time with plants just does a lot of good to your stress levels and your psyche—it’s something that I can’t quite explain, but when you start gardening, you’ll notice the change. Your mood gets better, your spirit gets lifted, and it just balances you out emotionally, and I’m always happy to hear that it’s done the same for our customers.

Spending time with plants just does a lot of good to your stress levels and your psyche—it’s something that I can’t quite explain, but when you start gardening, you’ll notice the change. Your mood gets better, your spirit gets lifted, and it just balances you out emotionally, and I’m always happy to hear that it’s done the same for our customers.

Note: The content in this article is provided for your information only and must not be construed as a guarantee of future results or legal, tax, or financial advice. Many factors influence the demand for your products, including price fluctuations and consumer demand shifts. Sellers remain responsible for determining the products they sell, their selling prices, and inventory levels. If you are in doubt as to the action you should take, please consult your legal, financial, tax, or other professional adviser.